This sheet helps you to track long-term expenses that you want to save for. Now, for savings, let’s start with our savings goal worksheet. Next, use the donations log to keep track of any donations you make throughout the year so that you can turn those in at tax time, as well.

I don’t usually know the actual amount until a month or so before they are due, but I can estimate and have the majority saved before the time comes. One that always sneaks up on me is car tags and taxes! Unlike the car payment that comes each month, we pay these once per year, and if I don’t plan for it, it ends up being a big unexpected expense. It makes you able to space out saving up for bigger expenses. One of the best things you can do for your budget is to plan ahead and get prepared. Use the yearly expenses page to plan for variable expenses that might sneak up on you- saving for Christmas or birthdays is a great example of this. It can be important to track these, even if you don’t necessarily have a lot of health issues, because it helps when it comes time to deal with insurance, or at tax time! This was so helpful for me when my son was younger and we had a lot of different expenses going on. The next page I included was a medical expenses tracker. Or, get in the habit of paying certain things a week or two ahead so that they don’t pile up all at once. HINT: If you do find that you have a lot of bills stacked on one end of the month, you can call your creditors, or the companies you pay to, to see if it is possible to change your due dates.

This helps you to space out when things are to be paid so that you don’t have most of your bills due at the beginning of the month, or so that if you do, you can plan for it! Knowing when you want to pay each bill is an important part of the budgeting process. The finance calendar is a great way to have a monthly overview of when you plan to pay your bills, so you know what to expect each week. I know that we have a lot of different due dates, and it can be hard to keep track, but this sheet makes it easy. This can help you save money by avoiding late fees or other penalties for paying late. The monthly bill checklist will help you keep track of your monthly bills that are paid and make sure nothing slips through the cracks. There are lots of lines if you need them, and you can also print more than one sheet if you find that necessary to track all of your spending. Use a new sheet each month and track everything you spend to know exactly where your money has gone. Next, the monthly expense tracker, or expenses log, is a sheet just for tracking your expenses on a monthly basis.

#Printable budget planner free free#

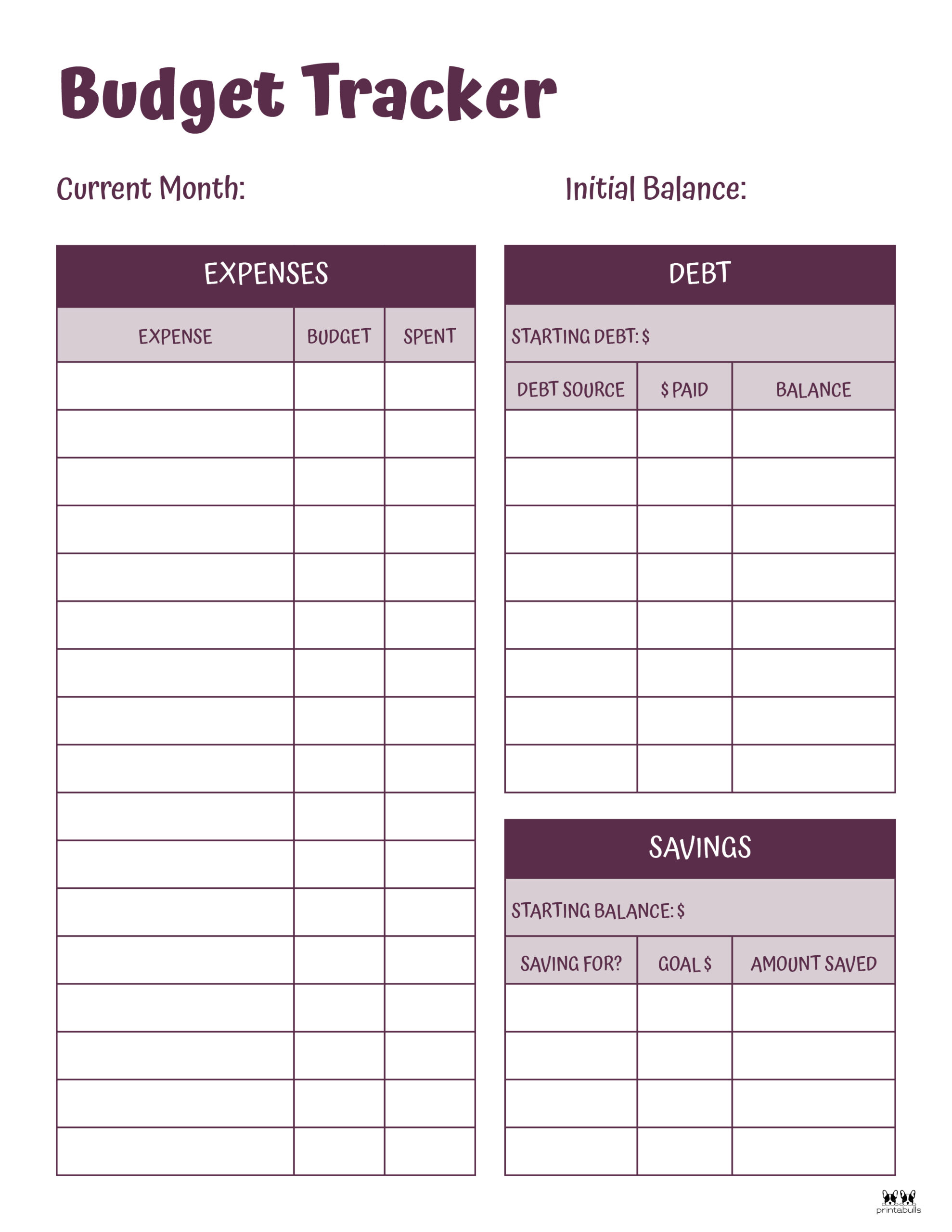

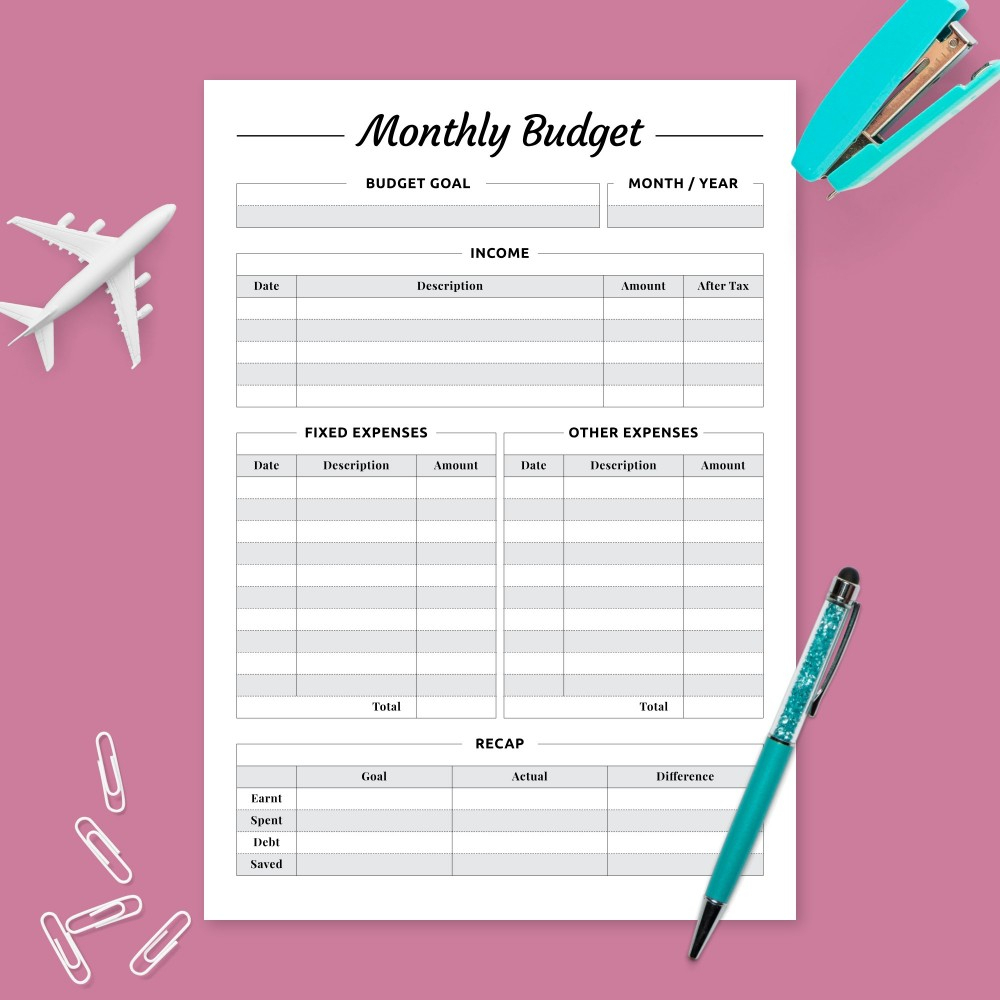

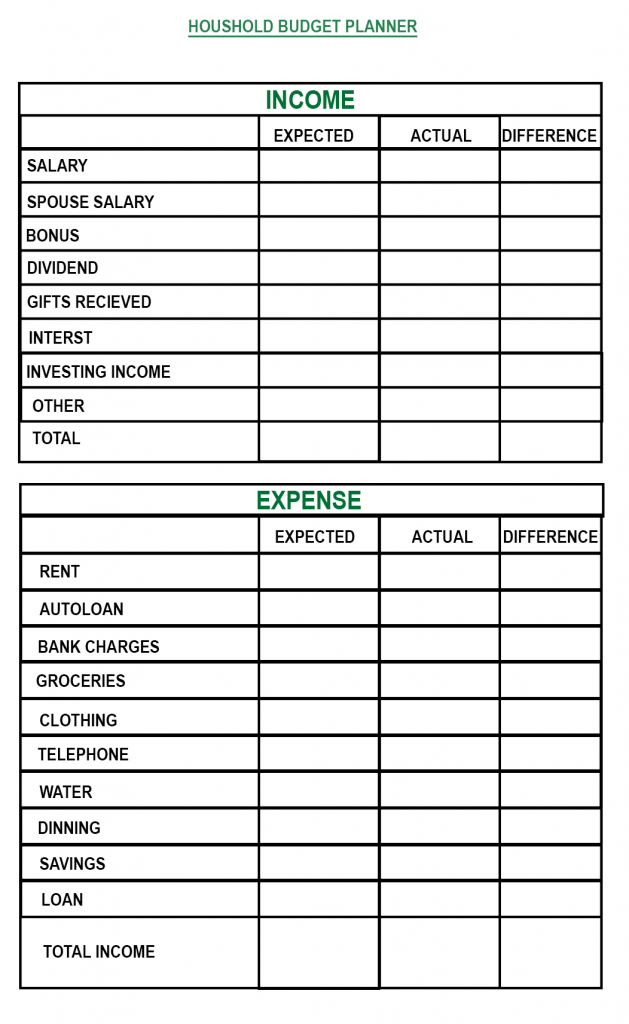

Use this free budget worksheet to plan your personal budget every month. It has space for you to track your total income, your bills due, monthly expenses, and savings and debt goals.

This is your main budget tracker sheet that is included and it provides a great budget overview. You can choose which sheet you prefer, depending on your paycheck frequency. Let’s take a closer look at what is included in this set- Free Budget Printables-įirst, is the weekly/biweekly or monthly budget planner page.

#Printable budget planner free download#

These printables are only for personal use, but I do have a few different colors you can choose from! Also, they are made in both letter and half letter size, which can fit into A5 size planner binders! They are free for subscribers so scroll down and sign up to download these, and all of my free printables.

0 kommentar(er)

0 kommentar(er)